This includes tax advice, alerts, and a capital gains estimator to evaluate

#USING QUICKEN FOR PERSONAL FINANCE PLUS#

Plus additional tools, information, and advice for investment decisions with its onlineįeatures. The Premier product includes the Quicken® Deluxe features, Payroll features can be added if you have Internet service and payĪ tax table subscription. In addition, there are time-saving entry features, account-tracking alerts, and onlineīanking features. To record transactions, run reports, print graphs, and reconcile your checkbook. Several versions of Quicken® are available.

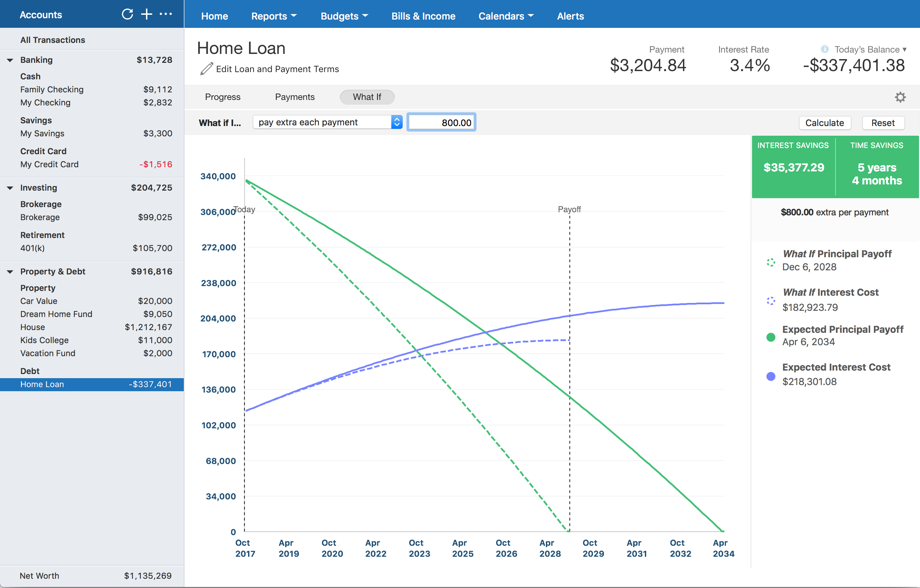

Likewise, it is difficult to maintainĪ depreciation schedule for individual assets. To spreadsheets for further summary and analysis. Quantities and price per unit information can be stored in memo lines and exported It hard to integrate production and financial records in reports and analysis. Summarize physical data associated with individual financial transactions, making Package, if a more sophisticated financial record-keeping system is required in theįor agricultural users a major shortcoming in Quicken® is the inability to easily Quicken®įiles can be imported easily into QuickBooks®, a popular small-business accounting On historic Quicken® data can be generated quickly and easily, as can budgets developedįrom “scratch.” Comparison reports highlight budget versus actual figures. Loans can beĪmortized with scheduled payments retained for future use.

#USING QUICKEN FOR PERSONAL FINANCE SOFTWARE#

Pertains to a specific tax schedule, and data can be exported to other software suchīuilt-in financial planning and monitoring features are also useful. Schedules are not generated, tax schedule reports summarize information recorded that Summary-are easily generated, information filtered and layout modified. Reports-transactions, cash flow, account balances, balance sheet, comparison, tax ForĮxample, a check written to a farm supply store could be separated into expenses forįertilizer for wheat, feed for hogs and fuel for checking cattle. Into as many as 30 components with different category and/or tag assignments. Splits of transactions allow a specific transaction to be divided QuickFill features recognize and complete repetitive transactions to reduce Sort transactions to allow cash reports by enterprise, by partnership share, or byįarm. The “tag” feature in Quicken® can be used with categories to further identify and University that matches the Schedule F, minimizing the effort required to develop

Import options allow you to add a farm category list created at Oklahoma State Although Quicken® includes only home and generalīusiness income and expense categories, farm income and expense categories are easilyĪdded. The Quicken® interface looks like a checkbook register and makes for a familiar environment Users can compare notes with neighbors on its application and use.

Quicken® is easy for people unfamiliar with accounting terms to Is a popular commercial record-keeping package that is: Software created specifically for agriculture is often expensive or cumbersome.

0 kommentar(er)

0 kommentar(er)